How Inflections Let Startups Change The Rules

The Pattern Breakers book is now available wherever you buy your books.

In my last post, I said that I'd noticed something strange:

Startups like Twitter, Twitch, and many others achieved extraordinary success while often seeming to disregard the usual "best practices." In contrast, many other startups I thought were highly promising often failed, even when they seemed to do everything right.

I became fixated on knowing why. Years of hard questioning drove me to a truth that surprised me. Underneath a breakthrough startup idea were powerful forces at work—forces more crucial to success than the idea itself.

The key forces are inflections, insights, and living in the future. The power of these three forces and a founding team’s ability to harness them provides the best explanation I’ve found for why some startups do so much better than the rest.

In my last piece, I touched on these three forces. Let’s pick up where we left off by going deeper into inflections.

What is an Inflection?

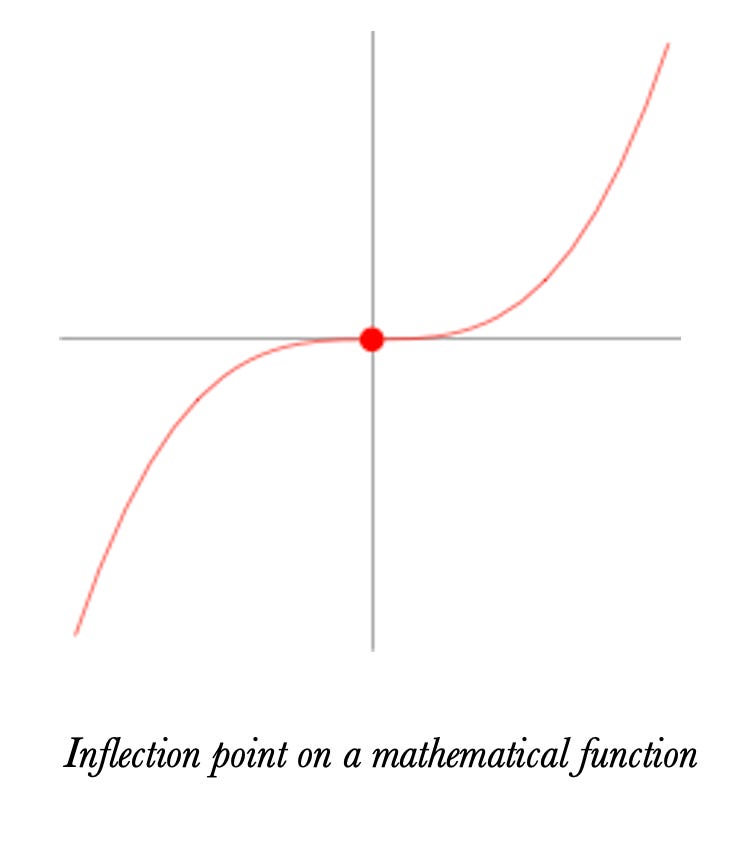

An “inflection” can mean different things. In speech, it’s a change in voice pitch. In Mathematics, it’s a point on a curve where the curvature changes direction.

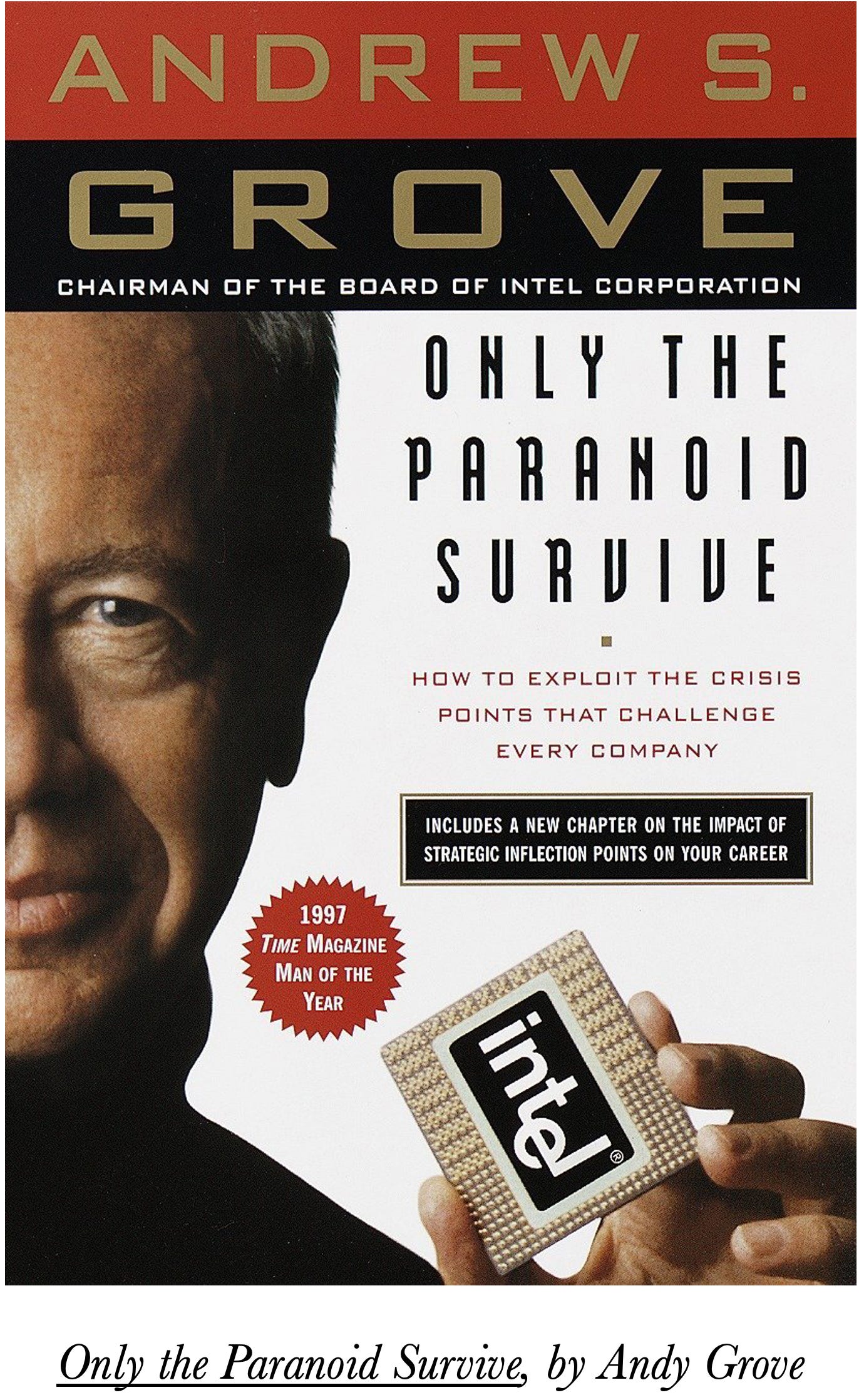

I first heard the term “inflection” applied to business by Andy Grove in the 1990s when he was the CEO of Intel.

In his book Only the Paranoid Survive, Grove described “strategic inflections” as a turning point in how people think, feel, and act: a change in what they value, what they believe, what they can do, or what they’re willing to do.

Inflections often threaten Incumbents

Several big companies have lost their market leadership or significantly declined due to their failure to adapt to strategic inflections. Some notable examples include:

Kodak: Despite inventing the digital camera, Kodak failed to transition effectively to digital photography at the crucial moment when it overtook film. It declared bankruptcy in 2012, the same year Facebook bought Instagram for $1 Billion.

Blockbuster: The video rental store giant was slow to adapt to DVDs by mail as well as the shift to digital streaming and online rentals. Upstarts like Netflix replaced them.

BlackBerry, Nokia, and Motorola: The leaders in mobile phones in the early 2000s were overwhelmed by Apple's iPhone, a strategic inflection that redefined the competitive landscape.

Grove stressed the need for vigilance and adaptability, even suggesting a healthy dose of "paranoia" for survival amidst such changes.

My view on inflections aligns with Andy Grove's but from another angle. Grove saw strategic inflections as significant threats that could overturn a company’s core business. Companies blind to these shifts or too slow to change risked their existence.

I see inflections through the lens of opportunity for the attacker - the startup.

Inflections are a startup’s secret weapon. Startups have nothing to defend. They want to upend the status quo. Inflections are the underlying force that pattern-breaking startups can exploit to change the future.

For the same reasons incumbents should be paranoid about inflections, pattern-breaking startups should vigilantly exploit inflections to change the future.

Different Types of Inflections

An inflection is a change event and not just any change. It's a powerful new development that expands what humans can do.

From a startup perspective, inflections are interesting because they create an opportunity to alter the rules that will govern competition in the future rather than simply improving existing products according to the current rules.

The advent of new technologies, new regulations, new society-wide attitudes, and new political or economic situations – all of these can be inflections that introduce the potential for radical change. All can be exploited by a startup, or any organization for that matter.

What follows are examples of different types of inflections.

Technology Inflections

I look most closely at technology inflections when sizing up startup ideas.

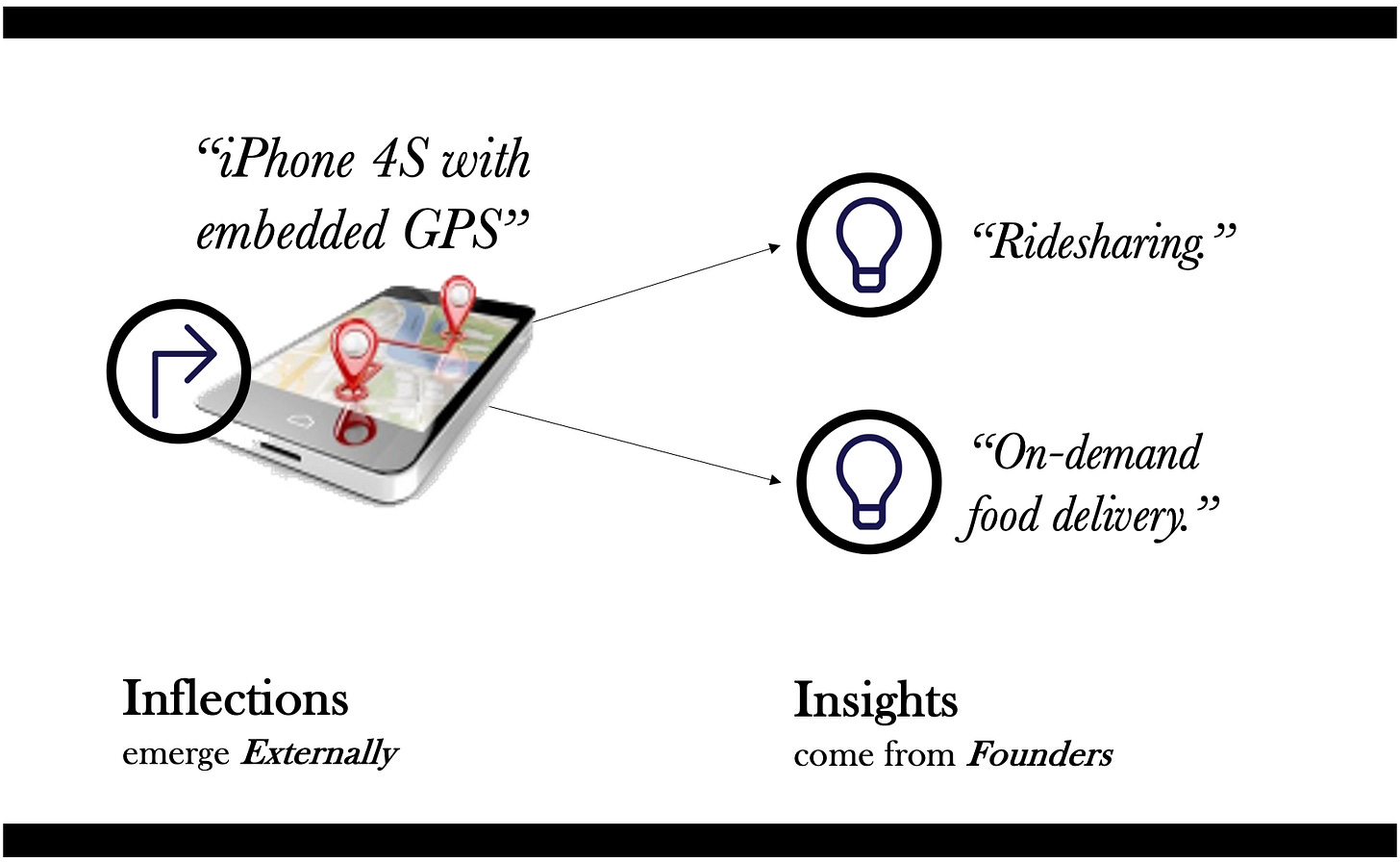

The iPhone 4s’s inclusion of a GPS chip is a prime example of a technology inflection. For the first time, app builders could know a person’s exact location. This inflection enabled startups to create new services like ridesharing networks, or on-demand restaurant and grocery delivery apps.

But inflections by themselves don't spark groundbreaking startups. They're like ocean waves; they come whether or not anyone uses them. The GPS in phones occurred as an external event to Uber, Lyft, Doordash, and Instacart. If nobody had the insight to unleash the potential of the inflection to transform human capabilities, ridesharing and on-demand delivery as we know them wouldn’t exist.

We’ll drill down on insights in an upcoming post.

Regulatory Inflections

Regulatory changes can also open up new ways to empower people.

For example, the COVID-19 virus required people to shelter in place, which resulted in new regulations. Beginning on March 6, 2020, Medicare started to pay clinicians to provide telehealth visits nationwide - not just within state lines.

This change event was powerful because it facilitated more choices and better economics for patients and Doctors. Now, patients could connect to almost any care provider, rather than limiting connections exclusively to patients and doctors in the same state or within narrow circumstances. Doctors, as well as patients, could benefit economically from the connections.

This regulatory change, along with the stay-at-home orders, massively sped up the use of telemedicine. In just three months after the pandemic's start, telemedicine visits jumped nearly eightfold.

Societal Inflections

Sometimes, an inflection creates a turning point in societal norms - a societal inflection.

The advent of the internet and social media changed more than technology and how we find information, shop, and meet. These changes transformed everything from politics to friendships.

Technology inflections and societal inflections often reinforce each other. For example, the printing press was a technology inflection in terms of its ability to empower people. But it also changed society by making books more accessible, leading to increased literacy rates, the spread of ideas, and significant impacts on education, religion, and politics.

Adoption Inflections

Sometimes adoption of a new technology reaches a tipping point that empowers a startup to offer something that will impact lots of people.

Take Airbnb. By the time it started, a critical mass of people had become comfortable shopping online and trusting reviews. Facebook Connect had recently allowed the sharing of profiles about folks who once were strangers. This helped both hosts and guests get more comfortable with the idea of renting extra space in someone’s house. I suspect that if someone had tried Airbnb earlier in the life of the internet, they would not have succeeded since users would not have trusted the platform enough to share personal information and stay with or host strangers.

The More Inflections, the Better

Sometimes, a bunch of inflections happen simultaneously to reinforce each other. Instagram provides a good example.

The first inflection that impacted Instagram was a turning point in the capabilities of smartphone cameras. The number of megapixels per dollar had increased in digital cameras since the early 1990s. In the 2000s, digital cameras started appearing on mobile phones. The first iPhone shipped in 2007 with a two-megapixel camera but no App Store and no 3G connectivity. Cameras and connectivity weren’t yet good enough for an app like Instagram to succeed.

Instagram launched in September 2010, roughly three months after the iPhone 4 shipped with the first 5-megapixel smartphone camera. This was further amplified by the massive acceleration of smartphone adoption, which went from 1.4 million phones in 2007 to 40 million in 2010 and 72 million in 2011. These tipping points in photo capabilities and the accelerating adoption of smartphones created a perfect storm for a product like Instagram to take off.

The first smartphone cameras didn’t empower enough people to take detailed photos or to share them broadly. But a set of inflections later converged, enabling Instagram to deliver new empowering capabilities for tens of millions of people at just the right moment.

The Anatomy of an Inflection

To understand the potential impact of inflections, it's best to stress test them with specific questions.

What is the specific new thing?

In the iPhone 4s example with embedded GPS locator chips, you’ll notice that the iPhone 4s was a specific new thing, not a trend, not a business driver, or a performance improvement curve.

People often conflate trends with inflections, but they are different.

We just mentioned Instagram and it illustrates this point as well. Digital photos had existed for quite some time. In 1994, Apple shipped the QuickTake camera, which held 8 photos at 0.3 megapixel resolution, and lacked the ability to let users preview or erase the photos before downloading them. Digital cameras continued to improve at an exponential rate from a small initial set of capabilities.

But digital camera improvements aren’t an inflection. An inflection is a specific turning point in the ability of a technology to empower people in new ways.

The first digital cameras didn’t let enough people to take the kinds of pictures they wanted to save for themselves or share broadly. But eventually, the iPhone 4’s camera hit an inflection where people decided it was how they wanted to take almost all of their photos.

How does the specific new thing empower people?

Who are the specific people this inflection would empower and why would they want its empowering capabilities?

Returning to the example of the iPhone 4s with embedded GPS capabilities, apps could locate smartphones precisely and algorithmically for the first time. Earlier smartphones contained location services that were far less accurate or reliable. Given the explosive adoption and rapid replacement cycle of smartphones, this change could impact tens of millions of smartphone owners in the short term and almost all of them in the long run.

A common pitfall is not understanding the empowerment offered by an inflection, who it affects, and the extent of its impact.

I see this a lot in pitches targeting climate change. An aspiring founder might say, “The world has decided it’s time to do something about the climate crisis. It’s now in the popular consciousness. People are ready to change their behaviors and buying habits.” My natural tendency is to say, “I agree with that sentiment. Now, let’s connect that with a new thing that empowers people in a specific new way. And further, let’s get clearer on why it can confer those powers on lots of people rather than just a few.”

I’m not saying I don’t invest in climate change startups - just that I think it’s important to stress test ideas for whether they have enough underlying power to truly create radical change. For instance, some climate change startups are leveraging a specific new technology or social behavior and have identified who that will impact and how. I take a much closer look at those type of startups.

What are the empowerment conditions?

Founders leveraging inflections are essentially betting on their potential to significantly alter the future, a future that remains uncertain and unformed. This necessitates a "thinking-in-bets" mindset, as discussed by Annie Duke in her book Thinking in Bets. The approach involves evaluating the probabilities and uncertainties associated with decisions and the range of possible outcomes.

For inflections to be transformative, identifying the conditions that must be met for their success is crucial. This involves not just recognizing when an inflection might bring about positive change but also understanding and preparing for scenarios where it may not. For example, the success of Lyft and Uber hinged on the widespread adoption of GPS-enabled smartphones and users' willingness to share their location data. Both bets paid off.

But not all bets succeed, even if the underlying technology is sound. Nuclear energy serves as a case in point; despite its promise to provide cheap, reliable, and carbon-efficient energy, it has faced obstacles from regulations, public opinion, and political opposition over the past fifty years, hindering its full potential to empower society.

Inflections give startups an unfair advantage

Business is never a fair fight. It's a skewed battle where the old ways favor the big players. Big companies have employees, customers, supply chains, competitive moats, an established reputation or brand, and many other assets a startup lacks. The biggest advantage incumbents enjoy may be the fact that people like to stick to familiar patterns.

We stick to our habits, and they gain inertia over time. Breaking the pattern takes something powerful—an inflection. That means inflections are the startup’s most significant opportunity to make a major impact. Insights are how pattern-breakers creatively weaponize inflections to wage asymmetric warfare on the status quo. The next post will draw a clear connection between inflections and insights.

How can founders harness the power of Inflections?

Most crucial thought: You can stress test your ideas for whether or not they have underlying inflections. Key questions to ask are (1) what is the specific new thing that creates the opportunity for radical change? (2) how does the inflection create empowerment for people? How will it empower people and who and how many will be impacted by the empowerment? (3) Under what conditions will the inflection realize its potential to empower people, and under what circumstances might its full empowering capabilities not be completely realized?

Be careful not to pursue seemingly good ideas not grounded in powerful inflections. If your idea is not grounded in a powerful inflection, it is a warning sign to think more deeply about what makes the idea powerful or question whether it is sufficiently compelling to be worthy of your time and sacrifice.

Be careful not to dismiss seemingly bad ideas grounded in powerful inflections. It’s important to remember that powerful inflections at the core of an idea retain their power, even if the ideas themselves change. Given a choice, I would prefer to start with a seemingly bad or ambiguous idea powered by strong inflections rather than a plausibly good or seemingly straightforward idea where I can’t identify inflections that are powerful enough to create radical change.

What questions does this raise for you?

What current technology inflections excite you? How do they hold up under the stress test questions suggested earlier?

Do some inflections you’re watching amplify each other?

Can you think of startups that hit it big without seeming to tap into any inflections?

Insights link the potential of inflections to the reality of pattern-breaking ideas, and that's where we're headed next.

Thanks for reading this far, and thanks for the helpful feedback. We're just getting started.

I’m trying to share these ideas with as many ambitious founders as I can, so I would be grateful if you can help spread the word.

Thank you!!! Just, thank you- for taking the time to help others. I am always inspired by your writing and podcast. It can feel very lonely trying to create something new and valuable, you give me energy to keep the faith:)

Hi Mike, very compelling writing as always. Man, I can't stop thinking about this idea around "why now"!

I really think that building a venture strategy around investing only around inflection points makes total sense. I mean, you have definitely proven that it works -- not only the idea but actually executing on it.

But even if it's a valid investment strategy to only invest in inflection points, I must say I don't agree with inflection points being a definitive pre-requisite for a successful startup. As I mentioned before I really do believe there are people who are able to see the world -- (as it lies before them, not as it's changing in front of them!) -- and identify dislocations and anomalies and transform that potential energy into kinetic energy.

Do you think your airbnb example really stacks up to passing "the specific thing" as you describe it? I don't think that "a critical mass of people had become comfortable shopping online and trusting reviews" qualifies as a specific thing. The GPS for Uber, 100% agree, but this, no.

Validating if your theory holds (as a ground truth, not only as a portfolio strategy) should be easy enough through reverse engineering. I asked ChatGPT to produce a random list of technology companies that were less than 10 years old when they exited for >1bn. It came back with this:

Mojang - founded 2009, exit 2014, $3bn.

Supercell - founded 2010, exit 16, $9bn

Twitch - launched 2011, exit 2014, $1bn

Slack - launched 2013, exit 2019, $20bn

Beats Electronics - founded 2006, exit 2014, $3bn

Kiva Systems - founded 2003, exit 2012, $800m

Mobileye - founded 1999, exit 2017, $15bn

Aruba networks - founded 2002, exit 2015, $3bn

Dollar Shave Club - founded 2011, exit 2016, $1bn

AppDynamics - founded 2008, exit 2017, $4bn.

Eyeballing that list, do all of these come back with an obvious "specific thing" to you?